|

| The top is done by now |

Surely some owners bought units as an investment. And perhaps developer Greenland Forest City Partners will rent out unsold units.

So now four units are for rent, via StreetEasy, for relatively affordable prices, not much above the rents at 461 Dean, which was built for rentals only and has 50% of the units below market.

That suggests the current glut in and around Downtown Brooklyn doesn't offer as much of a premium for a fully equipped condo building.

Also, perhaps, that apartments in a not-quite-finished building are harder to rent. Note that two of the units have no fee attached, which suggests the owners are willing to absorb the real estate agent's commission--again signs of a buyers' market.

It also suggests, based on my calculations explained below, that the buyers renting out units may not be conventional investors. The expected revenue from renting, at least at current rent levels, would be insufficient to meet monthly mortgage payments plus common charges/taxes, assuming a 20% down payment.

Then again, the early buyers in such condos pay cash. Assuming quick lease-up and regular renewal, the units would deliver a reasonable but modest return to a cash purchaser.

But many people with nearly a million dollars in cash might find more reliable investments. So, beyond the conventional purchaser who just wants a place to live, who's buying it as an investment?

I can only speculate, but several types come to mind, all of which could overlap. First, some who are just bullish on Pacific Park and Prospect Heights, assuming their investment will rise over time. Second, those who value real estate as a tangible investment above alternatives.

Third, those who'd like to get their cash out of China (or another country) and care less about the return on investment than safety of capital, even with the strong dollar.

That's why Shanghai-based developer Greenland Holdings, which owns 70% of the joint venture, has an advantage in connections to potential buyers from China and their families/friends--for a project once billed as "helping solve Brooklyn's housing crisis."

A buyer from China?

So let's look at Unit 319, a 653-square-foot one-bedroom unit, purchased by Zhen Xi, whose address is listed solely as c/o Jun Wang & Associates, a law firm with addresses in Flushing, Midtown Manhattan, and Beijing.

Founder Jun Wang is described as "chief legal counsel of several reputable Chinese enterprises."

Founder Jun Wang is described as "chief legal counsel of several reputable Chinese enterprises."It's a reasonable--if hardly foolproof--bet that Zhen Xi is from China, and isn't planning to live in the unit immediately.

A $3,500 rental

Unit 319 is listed on StreetEasy at $3,500, the middle rent among the three one-bedroom units currently listed.

(Note that unit 422, advertised as a one-bedroom for a seeming bargain price of $3,200 and without any square footage listed, is actually a 541-square-foot studio--or "loft-style apartment," according to the ad--that the owner seems willing to convert into a one-bedroom by building a wall.)

The rent for unit 319 is competitive with one-bedroom apartments at 461 Dean, which now rent for as high as $3,240 and were listed as high as $3,424.

For unit 319, maintenance of $729.86 plus taxes of $26.90 total $756.76 monthly. So monthly revenues, given $3,500 in rent, become $2743.24, or $32,918.88 annually. (Without the 421-a tax abatement, monthly taxes would be $779.10!)

Given the purchase price of $878,620, a tick over the listed $875,000, that annual revenue means a 3.75% return on cash, putting aside additional transaction costs and repairs.

What if buyer financed it?

With the caveat that I'm no investment or tax advisor, let's look at the calculators StreetEasy supplies for those financing an investment.

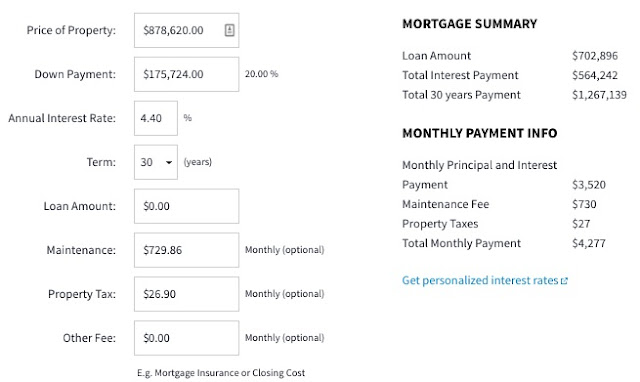

If the buyer put down 20%, $175,724, the monthly payment, at a 4.4% interest rate (which was the rate that showed up automatically at StreetEasy) would be $4,277, or well above the monthly $3,500 rent.

(For owners who itemize deduction on U.S. income taxes, depending on their income, the mortgage savings make the deal more attractive. Then again, the owner is not necessarily earning much return on that 20% down payment, either.)

What about a lower rate? Again, if the buyer put down 20%, but at a 3.4% interest rate, the monthly payment would be $3,874, also above the monthly $3,500 rent--though again more advantageous for owners who itemize deduction.

And that low property tax payment--for 15 years--surely helps the bottom line, and thus fuels higher prices.

Comments

Post a Comment